Thungela Long Term Outlook

- alex7frey

- Apr 27, 2022

- 1 min read

At these levels I think Thungela is overpriced. There I said it. #JSETGA was spun-off from Anglo #JSEAGL just last year on the back of mounting ESG pressure to divest from coal production. Since then TGA has risen from R29 to R176, up 5x.

This incredible rise has been driven by profits that are up from -R362m to R6 938m, a result of rising coal prices. For the last 10 years coal has averaged $50/ton. In the last year alone it has risen to around $260/ton.

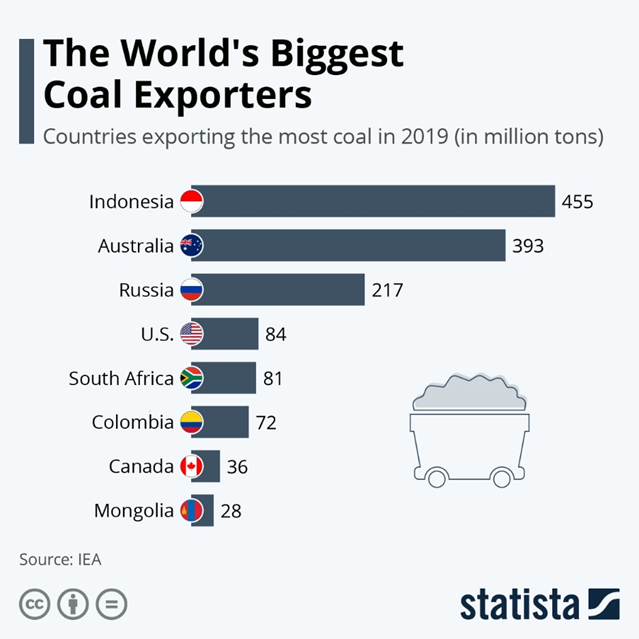

The price of coal has risen as economies open up and demand more. More importantly though, supply has dropped as Russia (one of the largest exporters of Coal) is excluded from trading with global partners in response to the Ukraine invasion.

As Warren Buffet says “Buy on the assumption that they could close the market the next day and not reopen it for five years.” Five years from now Thungela will face major head winds as the demand for coal continues its steady decline.

The EU & US have reduced coal demand by -18% YoY. For now, demand in China, India & Southeast Asia remains robust, but the long term outlook is far less optimistic. Asia is working to reduce its reliance on coal amid CO2 emission concerns and falling renewable energy costs.

I have also attached a report around regulatory clean up costs that Thungela could face. Make of it what you will:

As always these are just my thoughts and not advice. I’m eager to hear what everyone else thinks?

Tweet link:

Comments